What is Forex Trading or Foreign market?

The foreign exchange market, which is usually known as “forex” or “FX” is the largest financial market in the world. In this market a trader can trade in CURRENCIES PAIRS (EURUSD, GBPUSD, GBPJPY, etc..), COMMODITIES (Gold, Silver, Platinum, Energies etc..), INDICES (Dax, Dow, NASDAQ, UK100, FTSE etc..) and CRYPTOCURRENCIES independently by using of a trading account with anyone of the regulating forex broker.

| CODE | COUNTRY | CURRENCY | NICKNAME |

|---|---|---|---|

| USD | United States | Dollar | Buck |

| EUR | Eurozone | Euro | Fiber |

| JPY | Japan | Yen | Yen |

| GBP | Great Britain | Pound | Cable |

| CHF | Switzerland | Franc | Swissy |

| CAD | Canada | Dollar | Loonie |

| AUD | Australia | Dollar | Aussie |

| NZD | New Zealand | Dollar | Kiwi |

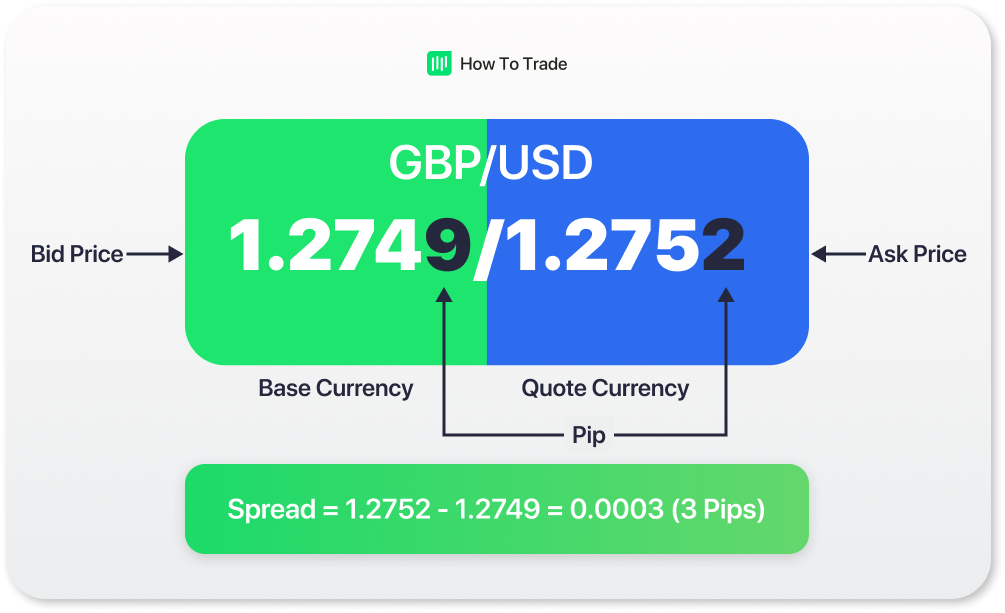

What is a Spread in Forex Trading?

Spread is the difference between bid price and ask price. USD/JPY would be 110.00/110.04. This quote indicates a spread of 4 pips. Bid Price – The “bid” is the price at which you can SELL the base currency. Ask Price – The “ask” is the price at which you can BUY the base currency.

What is a Lot in Forex?

A “lot” is a unit measuring a transaction amount. Basically the number of currency units you will buy or sell.

What are forex trading sessions?

It is true that the forex market is open 24 hours a day, but that doesn’t mean it’s always active the entire day. The forex market can be broken up into four major trading sessions: 1.The Sydney session 2.The Toyo session 3.The London session 4.The New York session.

What is Margin?

When trading forex, you are only required to put up a small amount of capital to open and maintain a new position. This capital is known as the margin. For example, if you want to buy $100,000 worth of USDJPY, you don’t need to put up the full amount, you only need to put up a portion, like $3,000. The actual amount depends on your forex broker or CFD provider.

What is Equity?

The Equity reflects the real-time calculation of your profit/loss. The account equity or simply “Equity” represents the current value of your trading account. Equity is the current value of the account and fluctuates with every tick when looking at your trading platform on your screen. It is the sum of your account balance and all floating (unrealized) profits or losses associated with your open positions.

What types of market Analysis uses in forex market?

There are three types of market analysis: Technical Analysis Fundamental Analysis Sentiment Analysis

What is Technical Analysis?

Technical is the study of historical price action, Generally In the world of trading, when someone says “technical analysis”, the first thing that comes to mind is a chart. Technical analysts use charts because they are the easiest way to visualize historical data! You can look at past data to help you spot trends and patterns which could help you find some great trading opportunities.

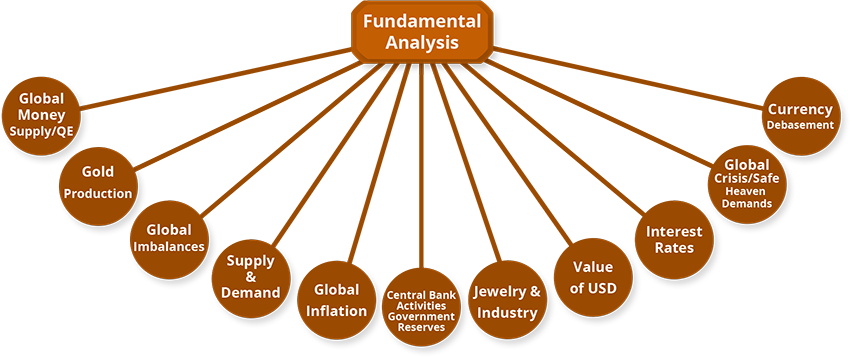

What is Fundamental Analysis?

Fundamental analysis is a way of looking at the forex market by analyzing economic, social, and political forces that may affect currency prices. it is supply and demand that determines price, or in our case, the currency exchange rate. Using supply and demand as an indicator of where price could be headed is easy. The hard part is analyzing all of the factors that affect supply and demand.

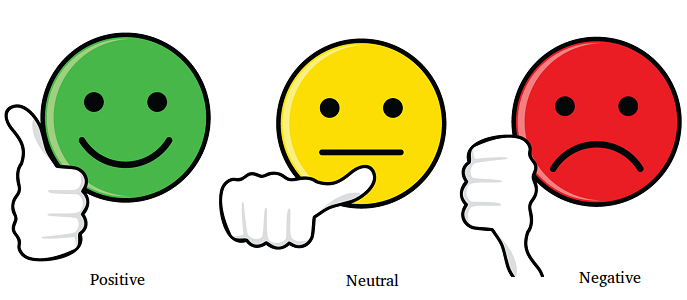

What is Sentiment Analysis?

Sentiment analysis is used to gauge how other traders feel, whether it’s about the overall currency market or about a particular currency pair. This is why sentiment analysis is important. Each trader has his or her own opinion of why the market is acting the way it does and whether to trade in the same direction of the market or against it.

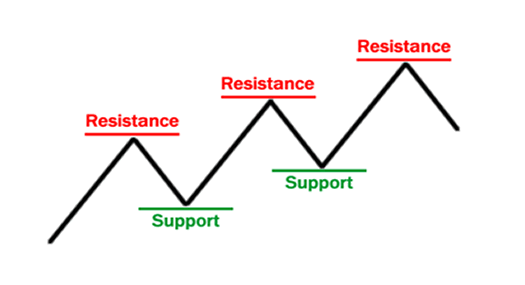

What is Support and Resistance?

When the price moves up and then pulls back, the highest point reached before it pulled back is now resistance. Resistance levels indicate where there will be a surplus of sellers. When the price continues up again, the lowest point reached before it started back is now support. Support levels indicate where there will be a surplus of buyers